The Latest From BizBuySell

SBA Loan Eligibility Tightens: What It Means for Foreign Investors

October 10, 2025

U.S. Government Shutdown Begins: What It Means for Small Businesses

October 1, 2025

How Much Money Do You Need to Buy a Business?

September 24, 2025

Small Business Owners Weigh In on Interest Rates and Business Valuation

August 22, 2025

Main Street Responds to Tariff Pressure With Pricing and Supply Shifts

August 20, 2025

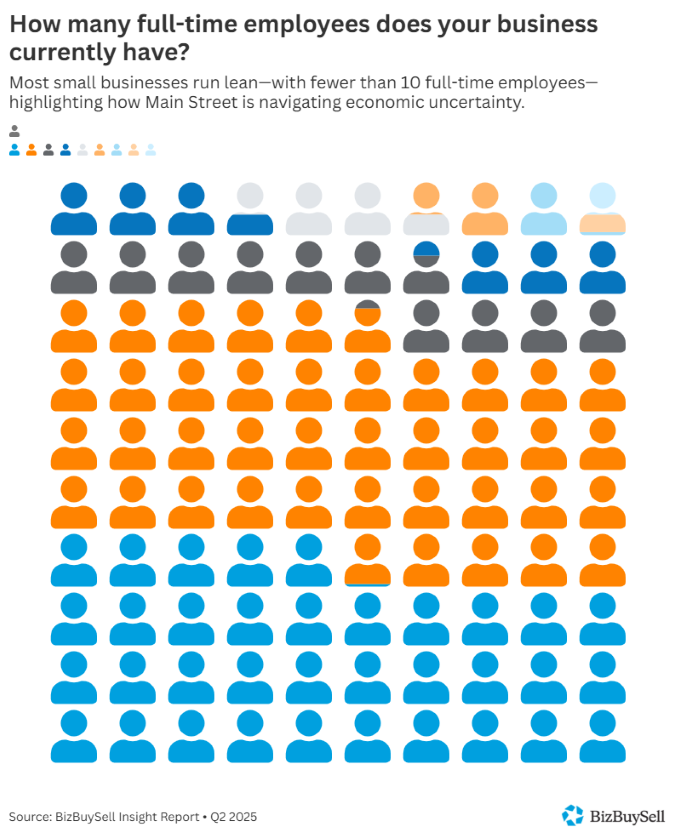

Main Street’s Hiring Hesitation Echoes in National Job Revisions

August 8, 2025

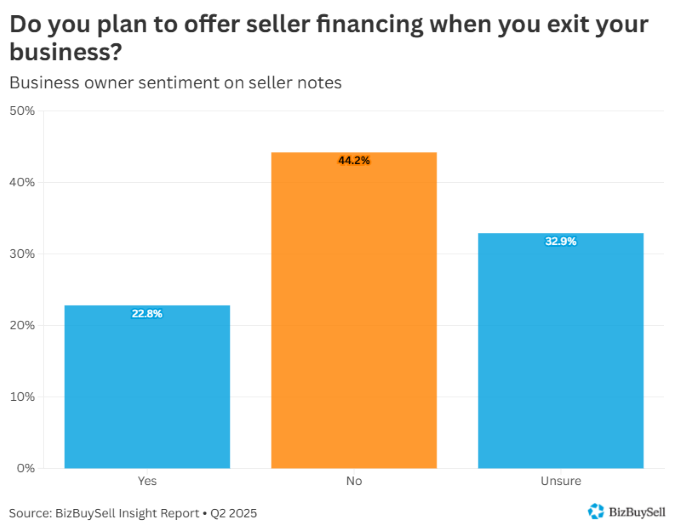

How New SBA Loan Rules Are Reshaping Seller Financing in Business-for-Sale Deals

July 31, 2025

How the Big Beautiful Bill Impacts Small Businesses

July 30, 2025

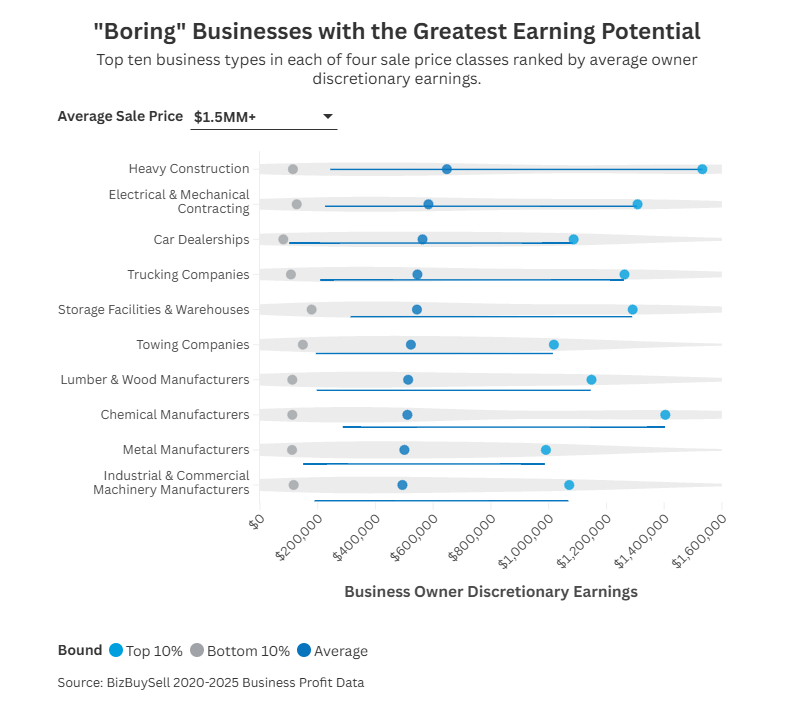

Why Buying a “Boring Business” Is a Smart Investment

July 25, 2025

Manufacturing Businesses: Is This the Right Time to Sell?

June 16, 2025

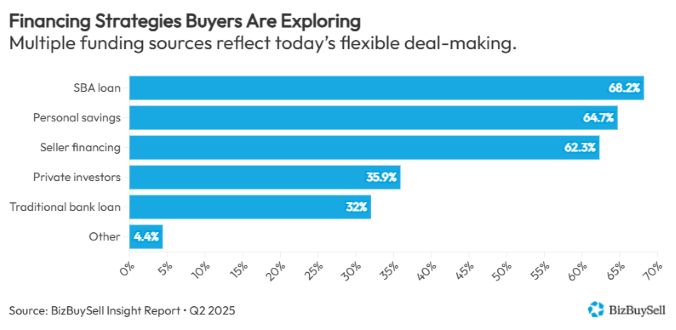

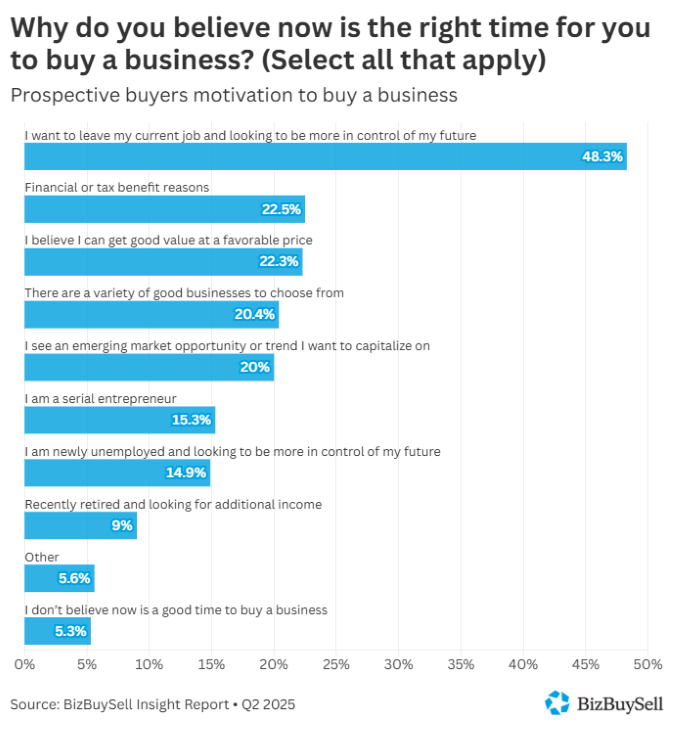

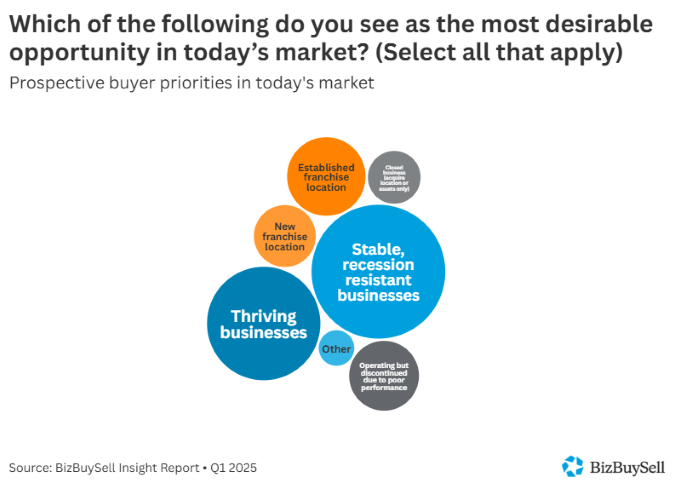

Buyers In Search of Recession-Resistant and Thriving Established Businesses for Sale

May 21, 2025

SBA Loan Changes Coming June 2025: What Small Business Owners and Prospective Buyers Must Know

April 25, 2025

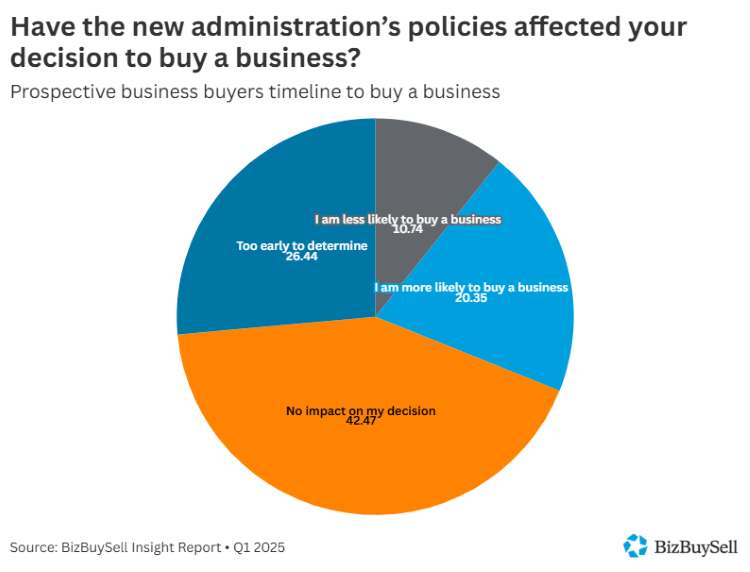

The First 100 Days of Trump’s Second Term: Small Business Sentiment Amid Uncertainty

April 25, 2025

Small Businesses Continue to Navigate Turbulent Trump Tariffs

April 18, 2025

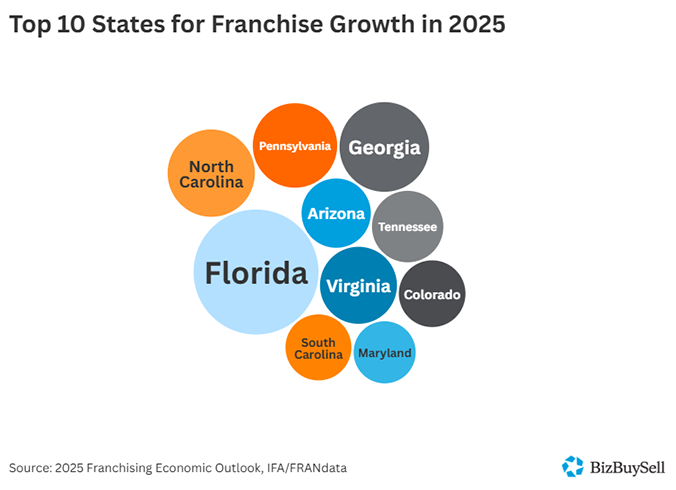

Franchise Industry Projects Growth for 2025 Despite Economic Uncertainty

March 28, 2025

Fed Signals Two Rate Cuts in 2025 as Small Businesses Navigate Economic Transition

March 21, 2025

The Face of Small Business Ownership: How Searchers Are Reshaping Main Street

March 7, 2025

Small Business Navigates Trump’s Tariff and Trade Policy Shifts

February 21, 2025

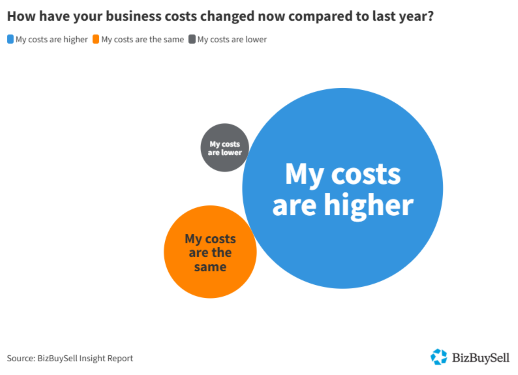

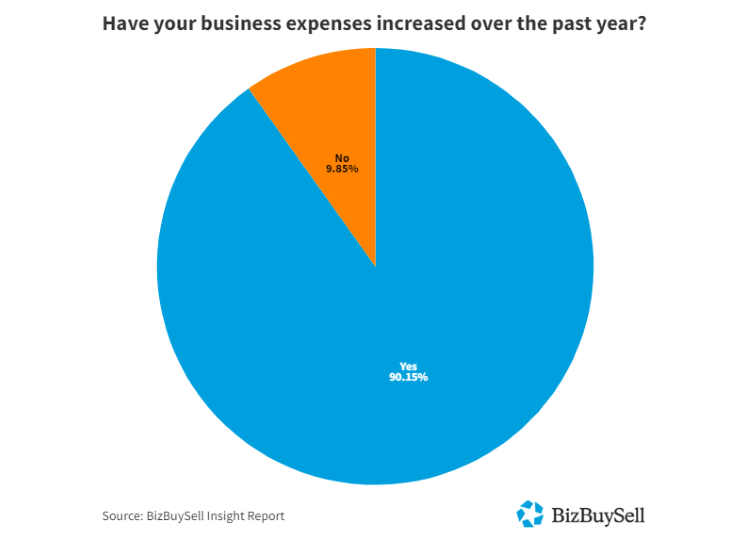

Small Business Owners Adapt to Higher Costs in 2025

February 14, 2025

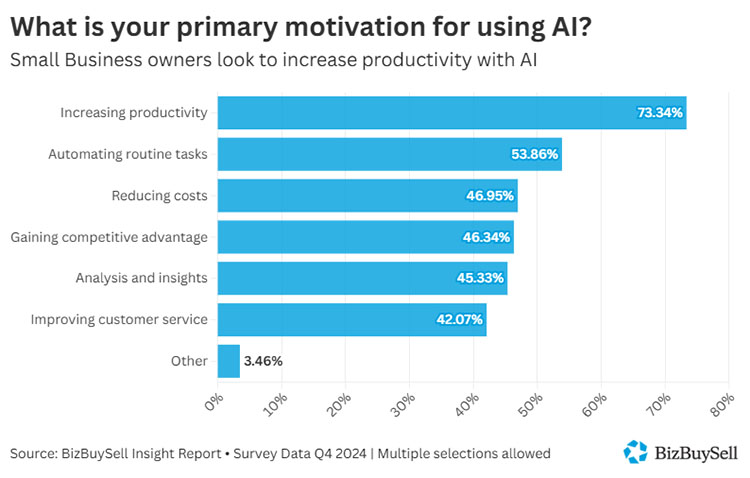

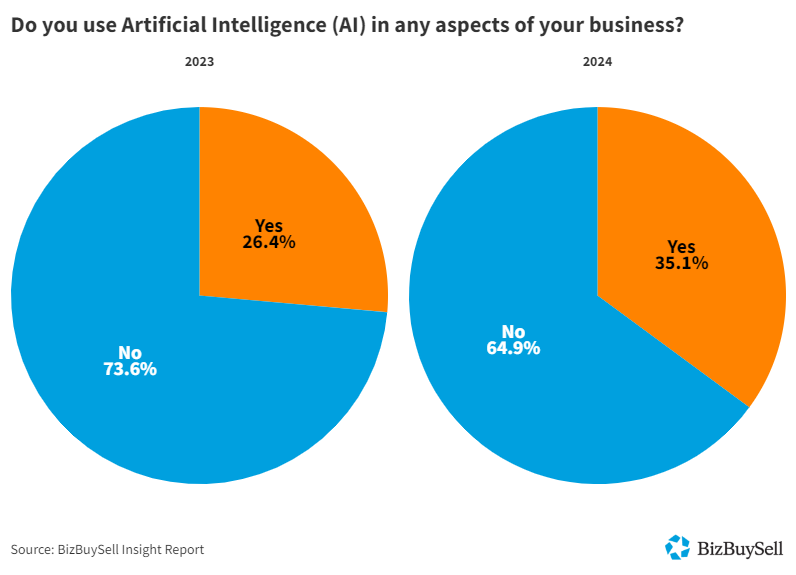

Small Business AI Adoption Trends

February 12, 2025

Small Businesses and the Labor Market in 2025

February 10, 2025

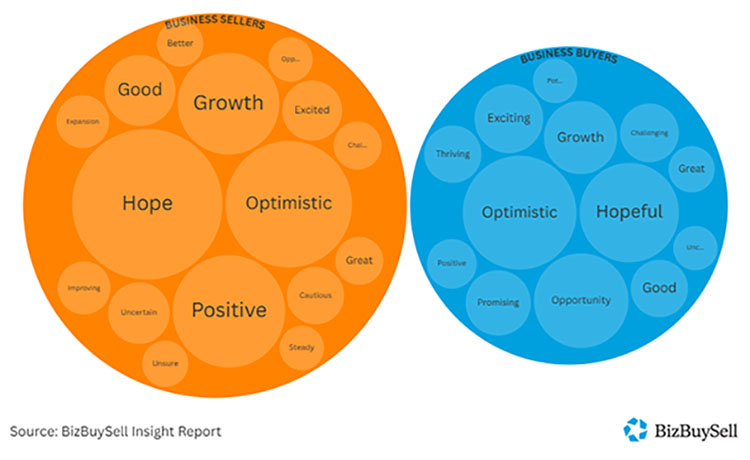

Small Business Outlook 2025: Optimistic Outlook for Both Business Buyers and Sellers

January 31, 2025

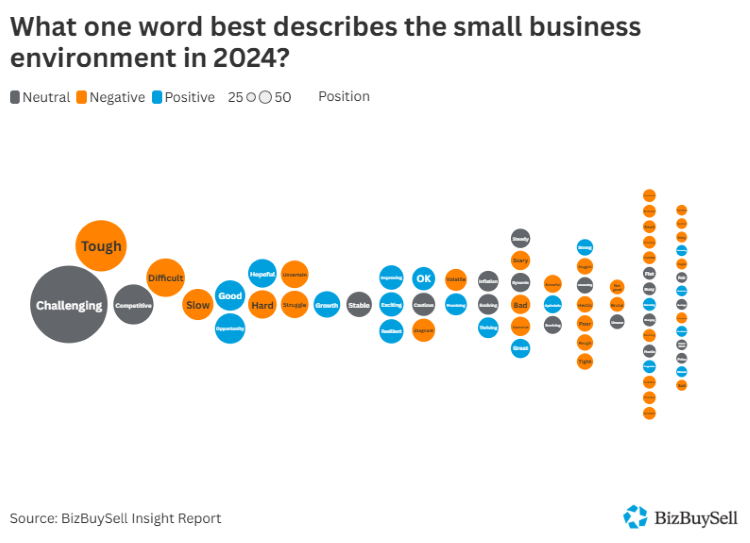

Small Business Owner Sentiment in 2024

January 24, 2025

Buying or Selling a Business: Essential Advice from Transaction Veterans

December 23, 2024

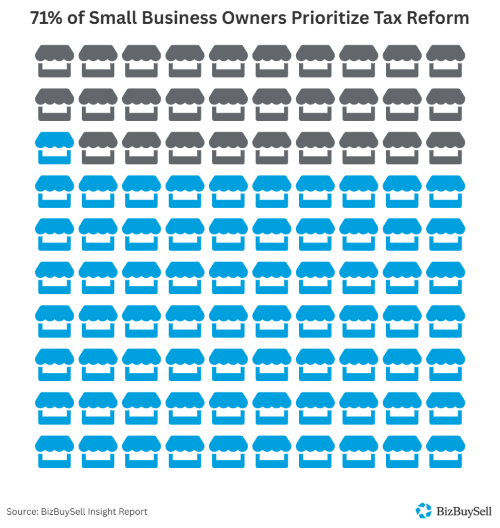

Small Business Owners Hope for Tax Cuts Under Incoming President Trump

December 23, 2024

Only 30% of Small Businesses Have Filed Required Ownership Reports as the January 1 Deadline Approaches

December 10, 2024

Small Businesses Gear Up for Trump-Era Tariffs

December 9, 2024

Shop Local: Small Businesses and the Holiday Season

November 27, 2024

Grants and Resources for Native American and Indigenous-Owned Businesses

November 12, 2024

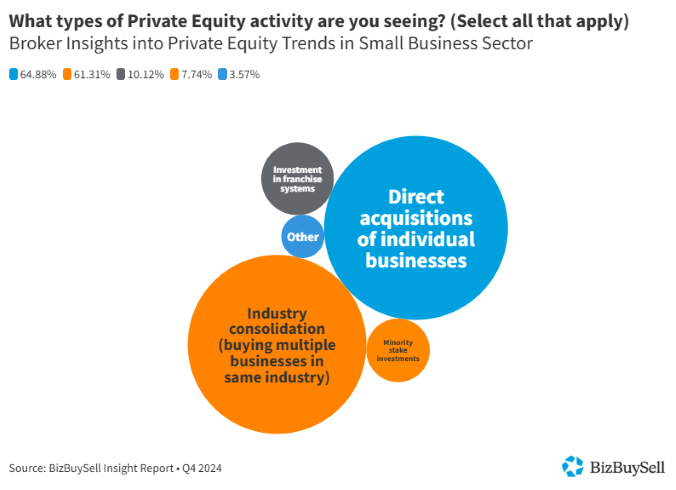

2024 Business Buying Trends: What Buyers Want

November 11, 2024

Resources and Grants for Veteran-Owned Businesses

November 5, 2024

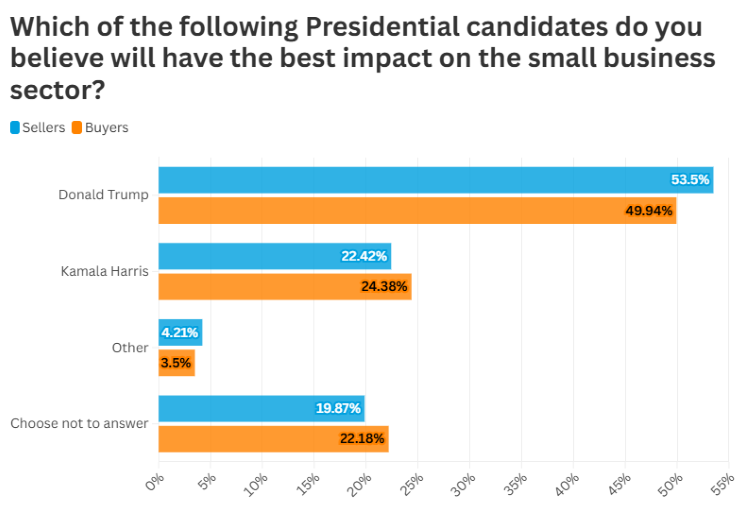

Business as Usual: 60% of Small Business Buyers and Sellers Staying the Course Despite Election Year

October 29, 2024

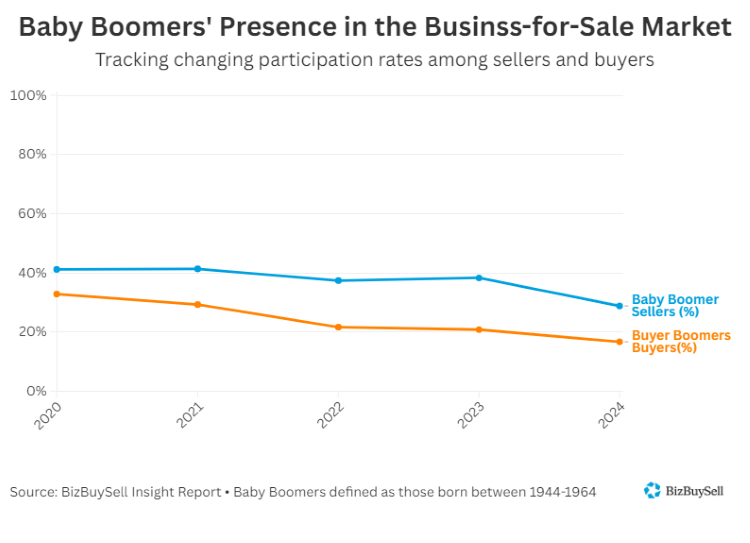

As Boomer Business Owners Exit, New Entrepreneurs Find Their Opening

October 24, 2024

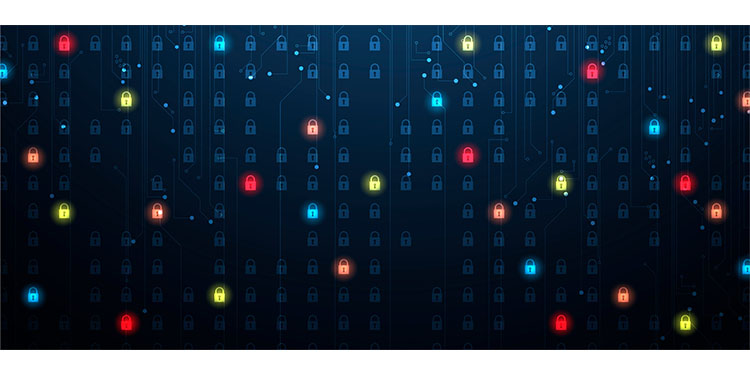

The Hidden Costs of Cyberattacks: Protecting Your Small Business's Value

October 14, 2024

SBA Rundown: What Small Business Owners Need to Know about Recent Updates

October 3, 2024

Buy Now, Pay Later: Balancing the Benefits and Drawbacks for Small Businesses

September 20, 2024

Fed Cuts Interest Rates: What It Means for Small Businesses

September 18, 2024

Grants and Resources for Hispanic-Owned Businesses

September 5, 2024

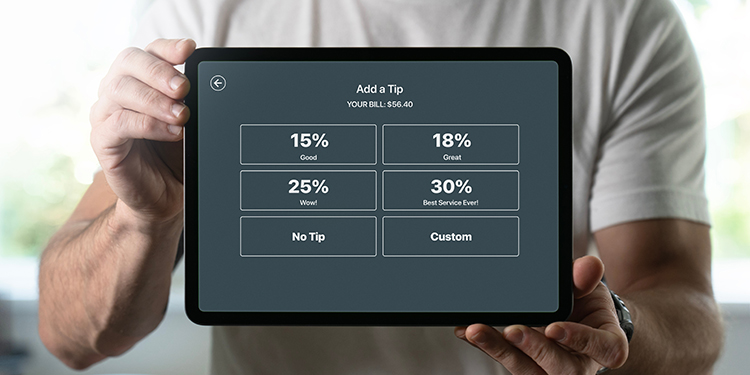

The Impact of Tipping Culture on Small Business Valuation

September 3, 2024

Credit Card Fees: Impact on Small Business Bottom Line and Valuation

August 16, 2024

The Role of Childcare as Small Businesses Navigate Labor Challenges

August 9, 2024

Small Businesses Leveraging Virtual Assistants

July 15, 2024

Bankruptcy Law Changes: Impact on the Business-for-Sale Market

July 8, 2024

AI's Growing Impact on Small Businesses

June 21, 2024

Navigating Supply Chain Challenges: Small Business Resilience

May 22, 2024

Small Businesses and Social Media: Staying Ahead of the Curve

May 20, 2024

How To Value Your Business, Enhance Its Worth, and Get it Sale-Ready | Webinar Event

May 7, 2024

Grants and Resources for AAPI-Owned Businesses

May 2, 2024

Small Business Week | April 28 – May 4, 2024

May 1, 2024

TikTok Faces Potential Ban: Small Business Owners Remain Optimistic

April 25, 2024

Small Steps Businesses Can Take to Make a Big Impact on Sustainability

April 19, 2024

SBA’s Streamlined Processes Fuel Record Small Business Loan Applications

April 15, 2024

The Solar Eclipse: A Big Opportunity for Small Businesses

April 8, 2024

Sustainability Grants for Small Businesses

April 4, 2024

Unlocking Value: Emerging Trends in the Pet Industry

March 29, 2024

Eatertainment: Boosting Business Value in the Food and Entertainment Sectors

March 22, 2024

Federal Reserve's Interest Rate Projections: What Small Business Owners Need to Know

March 20, 2024

Small Business Grants and Resources for Women-Owned Businesses

March 1, 2024

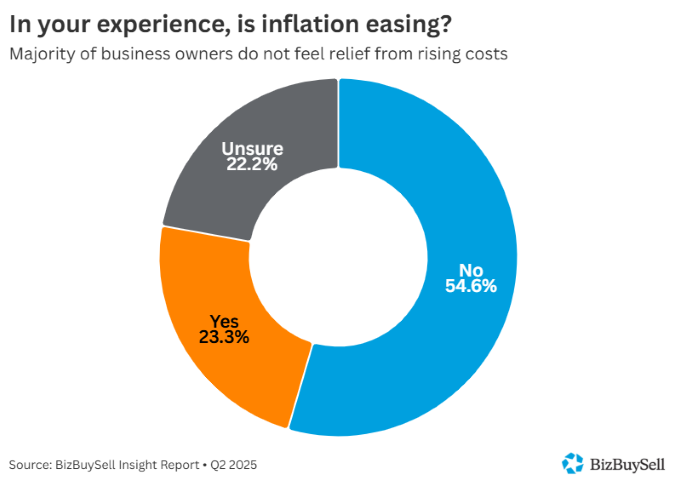

Small Businesses Tackling Inflation in 2024

February 16, 2024

Resources for Black-Owned Small Businesses

February 9, 2024

Retirees and the Business-For-Sale Marketplace: A Booming Trend

February 2, 2024

Small Businesses Compliance With the Corporate Transparency Act

January 26, 2024

The Impact of the Joint-Employer Rule on Franchises and Small Businesses

January 19, 2024

Small Business Economic Outlook in 2024

January 12, 2024

Main Street Businesses and 2024 Minimum Wage Hikes

January 5, 2024

10 Insights from Experts to Help you Navigate Buying or Selling a Business

December 22, 2023

Small Business Sentiment in an Evolving Economic Landscape

December 15, 2023

How Business Plans Drive Value When Selling and Buying a Business

December 8, 2023

Hiring Challenges and the Education and Childcare Industry

December 5, 2023

Beauty and Personal Care Business Trends: The Levers That Boost Valuation

November 22, 2023

U.S. Economic Growth and Small Business Valuations

October 27, 2023

Cybersecurity Month: Protecting Your Small Business

October 20, 2023

Franchise Owners Face Increasing Labor Costs as States Weigh Minimum Wage Increases

October 9, 2023

Small Businesses Brace for a Potential U.S. Government Shutdown

September 26, 2023

Family Businesses and the Business for Sale Marketplace

September 25, 2023

Main Street Businesses Navigate the Current Labor Market

September 11, 2023

Current Trends in the Healthcare Industry: Impact on Business Owners’ Valuation and Sale

August 31, 2023

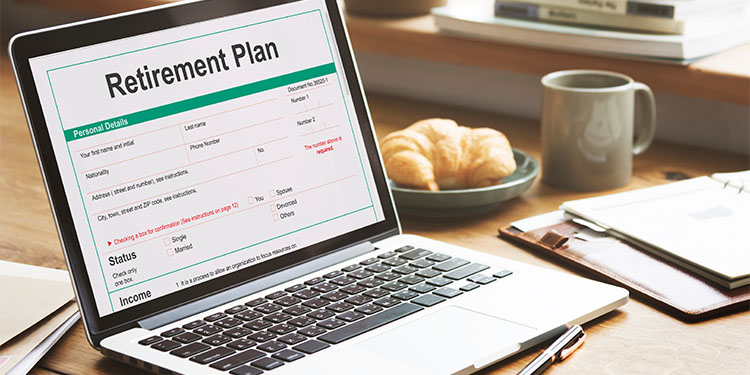

Retirement Strategies for Main Street Businesses

August 21, 2023

How Much Will a Business Valuation Cost?

August 18, 2023

Small Businesses Leverage AI for Growth

August 4, 2023

Interest Rates and Small Business Sentiment

August 1, 2023

Lenders Financing Business Acquisitions Looking for Seller Financing to Mitigate Risk

July 26, 2023

Business Brokers Can Create Great Listings by Following These 10 Tips

July 25, 2023

Evaluating the Importance of Electric Vehicle Repairs for Auto Repair Business Valuation

July 14, 2023

What Kind of Lawyer Do You Need To Sell Your Small Business?

July 12, 2023

Researching Franchise Opportunities? Call Franchise Owners Directly

June 30, 2023

Exit on Top: Why Now Is a Great Time to List Your Business for Sale

June 27, 2023

Take a Closer Look at an Edge Membership: Discover Powerful Tools to Help You Find the Perfect Business

June 27, 2023

How Far in Advance Should You Prepare to Sell Your Business?

June 23, 2023

SBA Loan Changes 101: How Do They Impact Buying and Selling a Business in 2023?

June 20, 2023

Grants and Resources for LGBTQIA+-Owned Businesses

June 20, 2023

2023: A Year of Growth for Franchises

May 26, 2023

In Which States are Most Businesses Sold?

May 16, 2023

What Does the Latest Interest Rate Hike Mean for My Business?

May 10, 2023

New Feature: Search Business For Sale Listings by Metro Area

May 9, 2023

National Business Broker’s Appreciation Day

May 4, 2023

Small Business Week | April 30 – May 6, 2023

May 3, 2023

Financing Advantages of Buying a Franchise in 2023

April 14, 2023

Does Stock Market Volatility Affect Business Sale Prices?

April 14, 2023

Retirement Plans for Small Business Owners

April 11, 2023

Is a Business Broker Worth the Cost?

March 31, 2023

Can Recent Layoffs in the Technology Sector Provide a Boost to Small Businesses?

March 30, 2023

How Will Recent Instability in the Banking Sector Impact Main Street Businesses?

March 21, 2023

America’s SBDCs - A Valuable Resource for Small Businesses

March 14, 2023

Labor Issues Continue to Impact the Small Business Industry in 2023

March 10, 2023

Reshoring, Nearshoring, and Insourcing Ease Supply Chain Issues for Small Business Owners

February 24, 2023

2023 to See More Baby Boomers Retire, Opening Opportunities for Entrepreneurs

February 9, 2023

The Future of Eating Out: How Niche and Quick Serve Restaurants are Shaping the Industry in 2023

February 2, 2023

Inflation is Taking a Bite Out of Restaurant Profits, but for How Long?

February 2, 2023

Rising Interest Rates Modestly Affecting Business Sale Prices

January 20, 2023

Selling Your Business When "You Are The Business"

January 19, 2023

10 Things Experts Want You to Know Before Buying or Selling a Business

December 21, 2022