CARES Act SBA Stimulus: SBA Loan Closing Timeline Update

Update: The deadline to close your SBA acquisition loan (9/27/20) has now passed.

Update: By August 2020, your SBA acquisition loan should already be closing in order to meet the September 27th deadline. The closing process typically takes 30-45 days to be completed.

Update: Due to high demand for this program, please ensure you have these items submitted to your lender as soon as possible to account for any backup in underwriting:

- Letter of intent or purchase agreement signed by buyer and seller

- Tax returns for business (including 2019 or extension filing)

- YTD P&L not older than 60 days

- Personal financial statement from buyer(s)

- Tax returns from buyer(s)

- Resume of buyer (optional)

“I need to close my loan before the CARES Act deadline” has recently begun to appear in new loan submissions through the BizBuySell Finance Center. Additionally, the question is often asked, “When do I need to submit my loan application to make sure my loan closes before the CARES Act deadline?”

The CARES Act allocated $17 billion to SBA loan payment forgiveness. The SBA will pay six months of loan payments, including principal and interest, directly to SBA lenders for all loans closed before September 27th, 2020.

I said in a recent webinar, How to Buy a Business with a CARES Act SBA Loan, that I would be sure to update our published timeline as the deadline approaches.

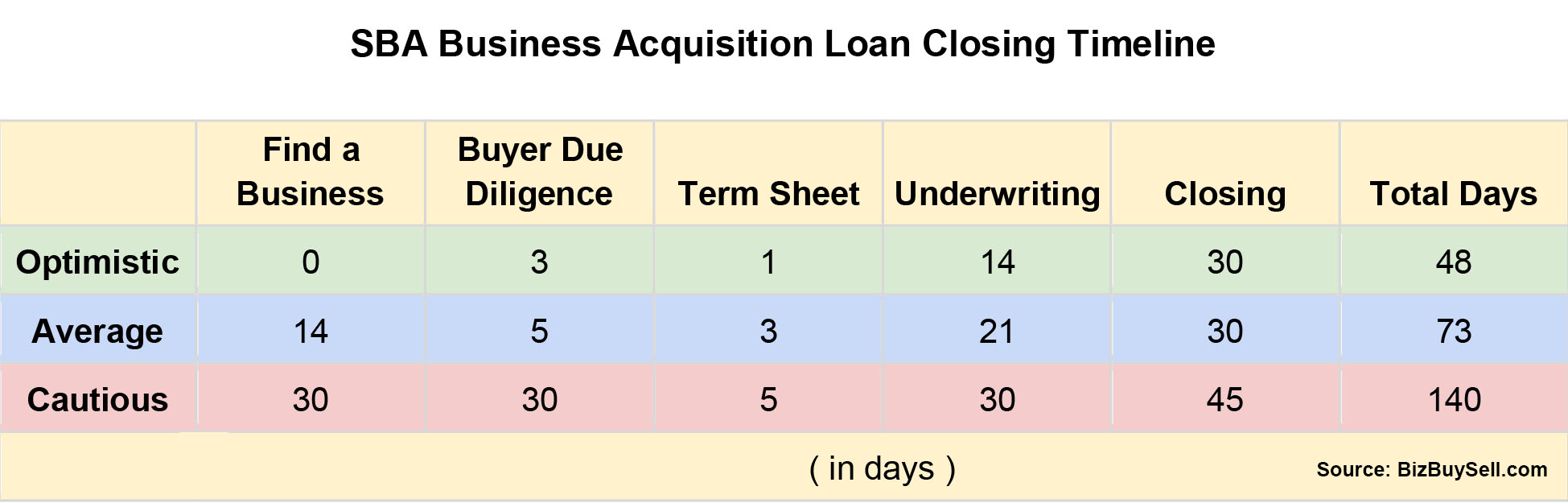

Here is a reasonable timeline to follow to ensure your SBA business acquisition loan closes before September 27th.

Let’s break down the timeline so you can determine for yourself which items may move smoothly or which items may need to be given extra attention by you, the seller, the business broker or the lender.

Step One: Find a Business — 0 to 30+ days

If you have not already found a business to purchase, consider this the most critical step to complete.

Start with searches on BizBuySell.com directly or find a business broker in the Find a Business Broker section of BizBuySell.

Buyers are very active right now and business brokers are busy helping buyers and sellers connect. You may have learned that finding a job should be treated just like a full-time job so treat finding your future business opportunity in just the same way.

Step Two: Buyer Due Diligence — 3 to 30 days

Due diligence, or initial buyer review, does not have to be a complicated, drawn out task. Depending on the type of business and your comfort level with the seller and the industry, you can complete this step while the SBA lender is also reviewing your file.

Once your offer is accepted, you should find an SBA lender. The BizBuySell Finance Center is a great place to start. SBA business acquisition lending is the most difficult type of SBA loan to close — the Finance Center can connect you to active SBA lenders that know how to close business acquisition loans.

Step Three: Lender Term Sheet — 1 to 5 days

A lender term sheet, or contingent commitment letter, should not take more than a few days. If you are using the BizBuySell Finance Center, once basic buyer financial information is entered, the system will request business tax returns, recent financials and a few other items to help the lender prepare a term sheet. This is, of course, assuming the buyer and the business are both qualified for an SBA loan.

Step Four: Underwriting — 14 to 30 days

Underwriting typically takes 2-3 weeks to complete. This is the process a lender goes through to gather all of the required information to obtain a formal bank approval. It is the process directly before the closing process.

Underwriting does not have to be a stressful process but there are a lot of documents that need to be retrieved from the seller plus due diligence by the lender on the buyer who will be the bank borrower.

Here are some examples of underwriting items which can hold up the process:

- Agreements such as seller non-compete, key employee contracts, landlord leases or lease extension.

- Contracts such as fuel supplier or other critical suppliers.

- Reports such as point-of-sale or STR reports to verify hospitality business occupancy. Disclosure: STR, Inc. is a division of CoStar Group which also owns BizBuySell.com.

- Customer contracts which might require a switch from an asset sale to a stock sale.

- Not returning the term sheet back to the bank along with the refundable deposit so the lender can assign your loan to an underwriter; order reports, such as a business valuation, appraisals, etc.; and formally begin the underwriting process.

- Not sending complete requests back to the lender in a timely manner such as password protected tax returns with no password provided.

- Sellers not quickly providing documents requested by the lender to be sent to the business valuation firm so a business value can be assigned to the loan.

- Problems verifying location-specific items such as liquor license transfer processes, as an example.

Step Five: Closing — 30 to 45 days

During the closing process, it will be important to work with the seller to complete the formal business purchase agreement if it is not already completed.

Here are some actual closing items that have complicated the closing process and needed to be resolved before loan closing:

- Liens on properties the buyer or seller wasn’t aware of.

- Verification of down payment sources going back 3 months per the USA Patriot Act anti-terrorism law. Gifts from family members also require sourcing.

- Sales tax accidentally left unpaid in one or more states.

- Legal representation during the formal purchase agreement drafting, review and signing.

- Last-minute logistical considerations such as being moved in time to run the business.

- Sale of property or other asset to fund the loan down payment.

Good communication and cooperation between all parties involved will hopefully ensure that your business acquisition and SBA loan close by September 27th so you can take advantage of the CARES Act SBA stimulus. Remember, all parties involved in your business acquisition have the same goal of closing your transaction as quickly and smoothly as possible.