Whether you are buying or selling a business, it's important to set your personal feelings aside to do a systematic business valuation. There are three common, acceptable methods to value a small business. One may be more suitable than another, depending on the business being valued, including its industry, size, and circumstances of sale.

A market-based business valuation is one of the simpler business valuation methods, and arguably the most relevant. This approach compares a business to other, similar companies that have sold recently to get a market value. You will want to find recently sold businesses with similar financials in the same industry and market, then use the selling price and financials to calculate comparable pricing multiples.

(Note that pricing multiples based on recent comparable sales are distinct from "rule of thumb" ranges, which are static "ballpark" ranges.)

Create your free BizBuySell account and stay on top of the market. Discover tools and features for business owners, buyers, and brokers.

An asset-based business valuation focuses on the "book value" of a business, and the primary accounting document used is the balance sheet. With this approach, business assets are valued and totaled, and any corresponding liabilities are deducted.

An asset-based valuation is often used in conjunction with other methods of valuation and may be required as part of the due diligence process for some companies. Small businesses with valuable assets, like real estate, may value and sell the business and its assets separately.

Struggling or closing businesses with little to no profit may often sell at asset-value in an asset sale. If the business in question doesn't have the net income to warrant a market-based valuation, then on paper, it's only worth the value of its assets. These assets include furniture, fixtures and equipment (FF&E), intellectual property, real estate, production equipment, and inventory.

To determine an asset-based valuation, a small business owner must take inventory of all assets used in the business. For some small business owners, there may be substantial assets in the form of company owned real estate, expensive equipment, or valuable inventory. All assets must be given a fair market replacement value, and added up to get to a total asset value.

Any outstanding business debts are then subtracted from the asset value to arrive at an overall business asset valuation.

An income-based valuation approach hinges on projected future earnings and is common in commercial real estate asset valuation. There are two variants of this approach, capitalization of earnings and discounted cash flow (DCF). Both methods aim to calculate the "present value" of future earnings, and give buyers an expected ROI and risk assessment.

With the capitalization of earnings method, the historical cash flow of an asset is divided by its capitalization rate, or "cap rate". A capitalization rate is expressed as a percentage and represents the rate of return on the capital, including equity components and debt. This method helps to identify risks and quantify the potential return on investment. A higher cap rate implies a greater return on investment at a higher level of risk.

Using an example to illustrate, in the Dallas-Fort Worth market, the average commercial cap rate is around 8%. A hotel owner/operator in Dallas with Net Operating Income (NOI) of $200,000 may start with the average cap rate to come up with a value of the hotel asset of around $2.5 million ($200,000 / 8%).

Cap rates for commercial real estate can vary widely between properties, with average ranges from 5-10%. Because business purchases are generally more risky than commercial real estate, an appropriate cap rate would likely be much higher - around double or triple the commercial real estate cap rate.

The discounted cash flow method takes the company's projected cash flow and then discounts that amount for risk using the weighted average cost of capital. This projection is usually calculated for one year and then assumes perpetual and constant growth. Because of that assumption, this method of valuation is best used when an analyst is confident about the assumptions being made.

A business appraiser would likely run both types of calculations to come up with a present value of future earnings. Present value is a good complement to a market and comp analysis, and acts as a sanity check on market prices.

All valuation methods hinge on financial performance, so the first step is preparing the company's financial statements. Gather financial records for the past three years, including:

If the business hasn't been operating for three years, consider using a projection model.

Next, work with your accountant to transform the income statement into a seller's discretionary earnings (SDE) statement, which adds back non-recurring purchases and discretionary expenses to more accurately reflect the cash flow to the owner. These expenses include the owner's salary and personal expenses, travel that's not essential to the business, charitable donations, leisure activities, and one-time expenses like settling a lawsuit.

(For more detail, see Seller's Discretionary Earnings (SDE): An Overview.)

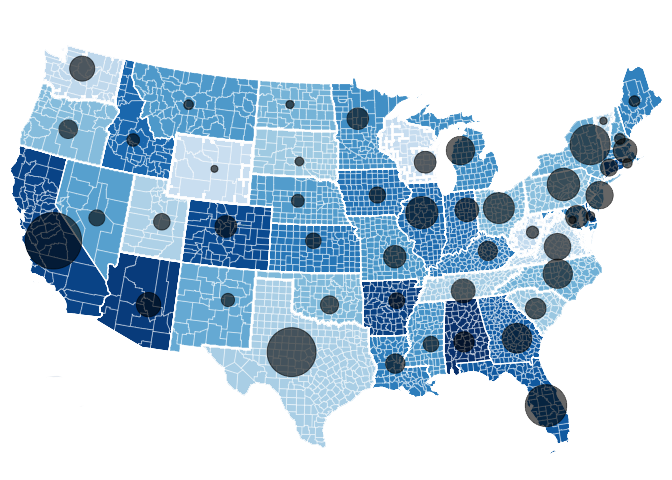

Recent sales of comparable businesses (or ‘comps') are a popular valuation rule of thumb that will offer you a realistic picture of what similar businesses are selling for. By identifying examples of similar businesses that have sold in the same area, you can get a better sense of a realistic selling price. These are also a source of data for finding an appropriate market multiple.

Comp data can be accessed through several online sources, as well as through a business broker, who can help to provide you with additional market insights.

Valuing a business requires a multilayered approach, so owners combine more than one business valuation method to get to a realistic range. Most small businesses start with an SDE multiple and add more analysis based on sales, cash flow, and growth trends. All these factors combined will give you the most accurate business valuation.

BizBuySell has many tools and resources to help you get started, whether you're buying, selling, or just looking for a market valuation: